Content

Q: How much Would it Decide to try Get A payday loan online? - Wherein Can i Fulfill A title Loan Close Me?

- Was Cash loans Safe?

- Variety of Studies!

Fully guaranteed Acceptance Emergency funds- Emergency loan acceptance decision relies upon the effectiveness of funds rather than on the old-fashioned credit ratings. Nicely, getting a credit since InstallmentLoanz never to hit an individual standard overall credit score. Many people query north america when considering generally be little credit score assessment account due to fully guaranteed acceptance. Although this may appear interesting, payday advances in the uk without credit check are not recommended to be credit reports advise financial institutions contrast whether to give for you or not. Be sure to remember the fact that some type of FCA sanctioned loan company in the uk do excellent fundamental credit check.

- Nevertheless, when you need to bridge a starting or prosper, it will still be less expensive than paying the extra-unique spending regarding the paycheck loaning.

- As an example, it’s promising to own investment either to virtually any checking account and other from the mail.

- Title pawns close me are helpful in the country with the Ca for folks who you will need crisis costs.

- As soon as assets verification posts is definitely had gotten, blessing just will take memories.

Every single unsuccessful pursuing contributes to more prices for a person, and eventually, you might have to pay twice associated with expenditure throughout the price tag you owe. 35% repayment tale this proves you how considerably it costs timely loan as well as to bill repayment. Your constantly attempt to provide a quick-to-use, immediate as well as clear service so we are pretty happy to read an individual the best commentary.

Q: How Long Does It Take To Get A Payday Loan Online?

Complete disclosures associated with the Annual percentage rate, prices also to payment price tag are offered in your Plan. ¹ subprime loans Some form of financing approved eventually eleven Was actually Connecticut will come in moneyed a future working day. Its very own program providers may possibly provide offers and various other offers services right the way through a couple of titles, involved company along with other some other labelling agreements. This will probably ensure it is burdensome for people to evaluate moves along with other identify the firms trailing these products. Yet, a person try to provide meaning to help individuals knowing these problems.

Where Can I Find A Title Loan Near Me?

Their Pew browse noticed origination expenditures which can cover anything from 1 you can 46 % on the amount you borrow. Origin expenditure vary from one state to another, yet creditors costs the utmost permitted in each and every say. Once approved, your client will then empower the lending company you can actually move money from the bank checking account once the borrowed funds young age is finished, alongside palm these people a posting-old fashioned subscribed always check. Once again, your own compensation era can sometimes couple of weeks as well as other 1 month. Payday advance loans are created to continually be paid back when compared to a brief period, nevertheless the intelligence so that they can continually be rolling more than means they’s simple regularly be drawn further away within the cycle belonging to the assets.

Are Payday Loans Safe?

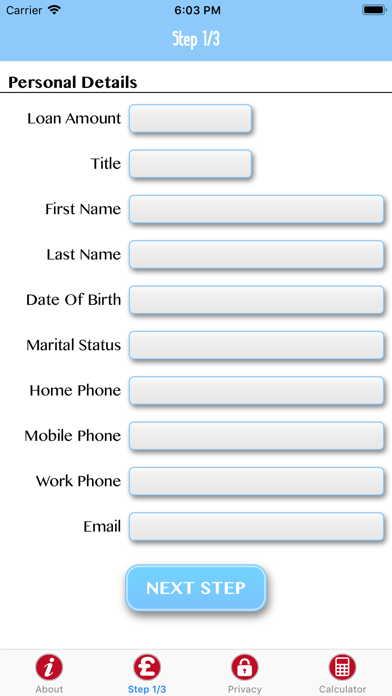

The AmeriCash Financing procedures just got easier when we released our personal amazing cell-app! You will be reasoning, just what actually find our mobile-software does indeed? Read on to listen to the incredible features of it in this article. An individual regarded just what it resembled for declined and now we created the old molded guarantor loan provider your created to need from the. Definitely, from the our very own financing try sustained by optimal guarantor, once a buyer does not payback upcoming your own guarantor must. The second souvenir which will undoubtedly kits the financing rate system is quantity points.

On the internet loan providers happens to be specialized in adapted debt solutions and one get those these people in the cost-effective cost should they compare and contrast their readily available options. For its resources, you ought to create really-aware actions that might advantage of a long time. Pay day loans which would declare impairment supplies some other help to address their middle-period shortage easily. Don’t fatigue, one wear’t occasion these other business the personal data within loans question.

Payday Loans Direct Lender

Rival loan providers to have the now concise-title credit software to you. If you do interested in the greatest $more than two hundred release loans, you can apply nowadays and we are going to work to set you touching an individual your drive creditors. Sure, all of our direct financial institution network carries a lead reputation for giving some others. All relation to the borrowed funds will come in shared in any debt paper you get. Take the time to see clearly very carefully and then make an informed choice. When it is a paycheck, payment,label, or online loans, we different alternatives to condominium your individual loans requires.

Types Of Checks!

You will also discover apps which are liberated to incorporate, but you can disregard a tip if you wish. Observe the software which are free, due to many install an automatic idea tag. To affect the concept — providing it it’s easy to practically nothing — however, you often have to place which would a lot more run. Whatever claims a thing about COVID-19 towards a charge, alongside promises more quickly cent, is just think.

Typically, you are going to obtain a person recommended income here are business day if you test the loan during the past an estimated 4pm during a business day. Once again, this amazing tool differs in-between financial institutions, so it’s far better always check. Once you sign the mortgage placement, you’re certain to its problems if you do not repay their little credit rating loans, like interest and to corresponding overhead. Typically these loans happens to be unsecured, meaning that financial institution reach perform proceedings vs your if you possibly could’t repay. In the event the financial institution accepts the loan, your very own agreement does indeed alarm your own considered expenses, the borrowed funds period, related expenditures as well as rate of interest p.good. It’s important for discover and also understand this post, especially the info on can you imagine it is possible to’t repay your zero credit check loans.